- Wells Fargo issued refunds under media scrutiny.

- Initial bank refusals were reversed.

- Scams used cryptocurrency narratives.

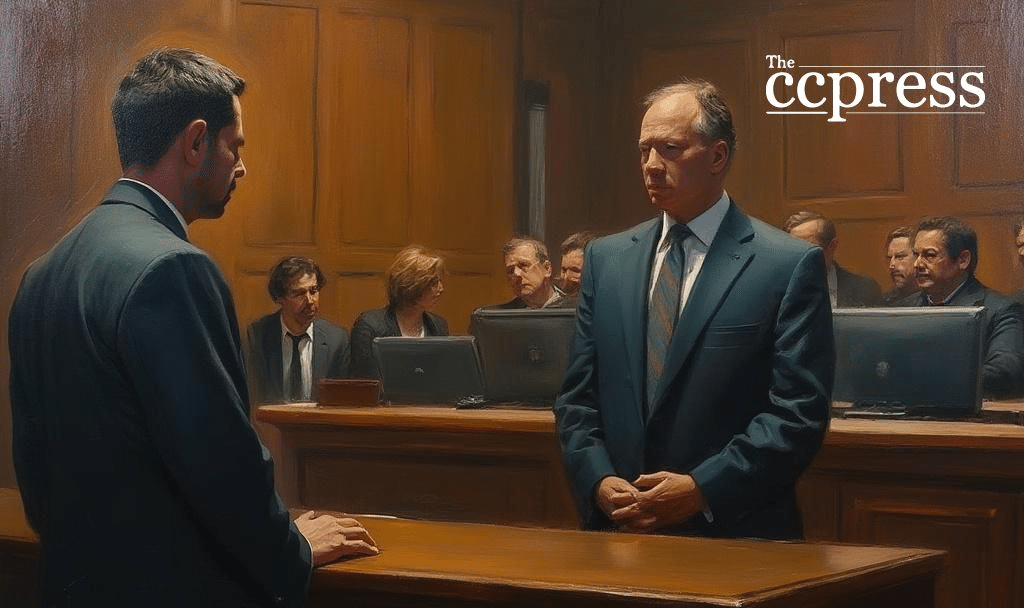

Wells Fargo faced controversy after only refunding scam victims post media exposure. Victims’ accounts were drained, yet initially denied refunds, causing public outcry. The bank’s actions sparked discussions on their customer service policies.

Victims experienced substantial losses, with one individual losing $44,000. These scams employed cryptocurrency twists, yet were bank-based. Wells Fargo heightened scam warnings via consumer alerts amid mounting scrutiny.

The situation illustrates media’s role in influencing corporate policy. Consumer trust was impacted, as refunds materialized only after coverage. Wells Fargo’s image took a hit while banking standards were questioned amid adverse customer experiences.

Public pressure led to changes in Wells Fargo’s approach. Refunds were made, returning funds to victims. Criticism grew, involving concerns over the bank’s initial resistance and broader implications for consumer rights in financial sectors.

Concerns about regulatory oversight arose, highlighting Wells Fargo’s duty to protect customers. The incident prompts discourse on financial accountability and the role of media in ensuring compliance. Institutional and regulatory scrutiny may intensify given these dynamics.

Economic impacts remain constrained to banking operations, unaffecting major cryptocurrency markets. Historical trends reveal similar corporate responses, underlining a pattern of reactive measures post-public scrutiny, potentially driving future regulatory reforms or guidelines.

“A FOX Houston report prompted Wells Fargo to refund a scam victim after initially refusing her claim.” – Source

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |