- Passage of CLARITY Act and its market impact.

- Regulatory clarity for U.S. digital assets.

- Increased global competitiveness for U.S. markets.

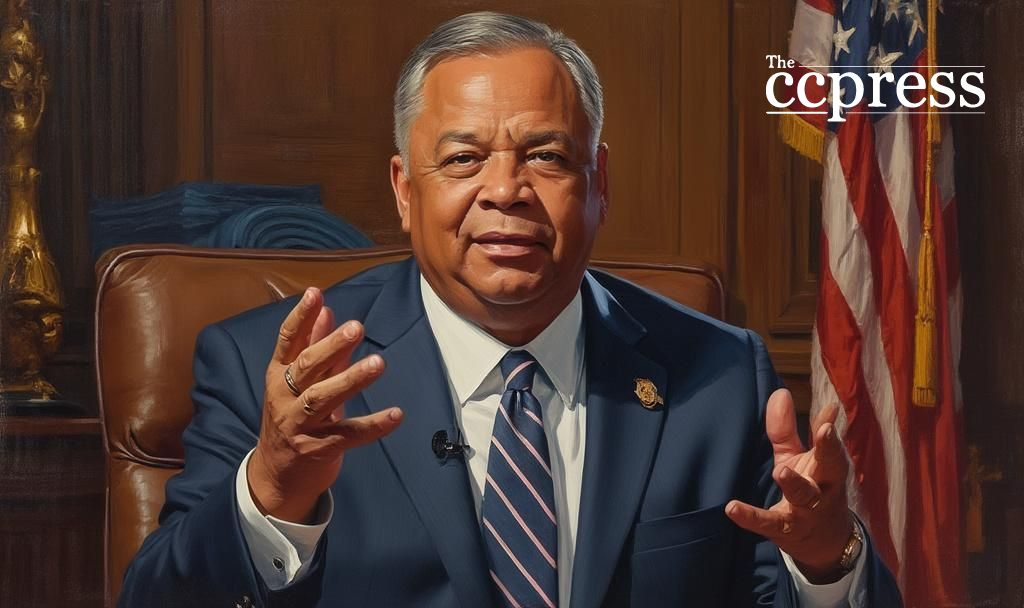

Rep. Dusty Johnson announced the passage of the CLARITY Act on October 2023 in Washington, D.C., initiating a new regulatory framework for digital assets.

The legislative decision provides clarity to the U.S. digital asset market, potentially increasing international investment and impacting market structure.

Rep. Dusty Johnson played a crucial role in passing the CLARITY Act, designed to provide a consistent regulatory framework for digital assets in the U.S. This move aims to protect investors and enhance competitiveness in the digital market.

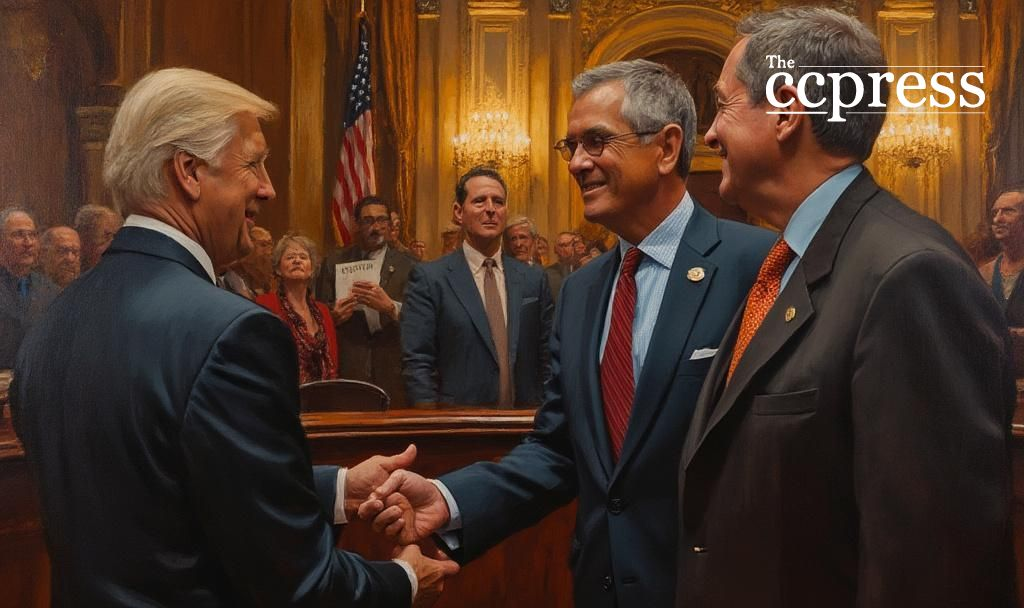

Johnson, alongside leaders like French Hill and G.T. Thompson, pushed for this bipartisan initiative. The legislation creates clear rules for cryptocurrencies and stablecoins, defining oversight responsibilities between the SEC and CFTC.

The act is expected to reduce regulatory risks for institutional investors, which could lead to increased capital inflows. Stablecoins such as USDC and USDT, and core tokens like ETH and BTC, may see a positive shift in market dynamics.

Financial implications include increased demand for U.S. Treasuries and solidifying the dominance of the US dollar. As Senator Bill Hagerty stated, “This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the US dollar. It will increase demand for US Treasuries.” On a political level, such clarity seeks to drive U.S. leadership in blockchain technology globally.

The crypto community has responded optimistically, with the announcement stirring increased engagement across digital forums. The act’s provisions facilitate a growth-friendly environment for blockchain innovations.

Potential outcomes include heightened investment and technology advancements. Based on European MiCA experiences, U.S. actions could similarly boost Layer1 and stablecoin-related tokens, enhancing their market positions.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |