- Peirce emphasizes regulatory clarity at Bitcoin 2025 conference.

- Focus on creating a favorable environment for innovation.

- Reinforces Bitcoin’s security, warns against risky memecoins.

Regulatory clarity is crucial for fostering innovation and compliance within the cryptocurrency space. Peirce’s remarks highlight the ongoing dialogue between regulators and the crypto industry. Immediate market reactions remain subdued, with a focus on long-term implications.

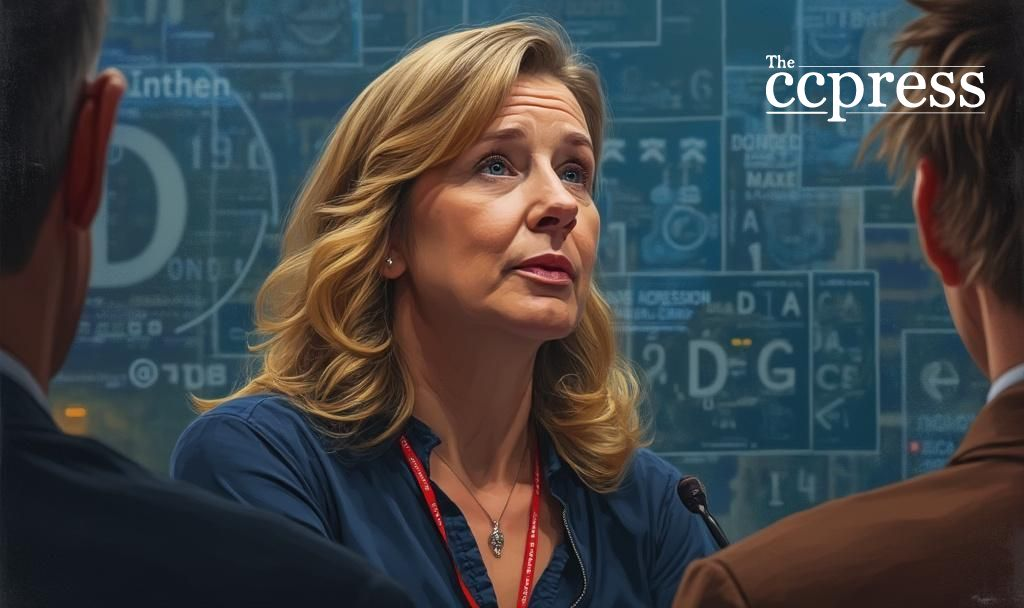

During the Bitcoin 2025 event, Hester Peirce addressed the cryptocurrency industry’s need for regulatory clarity. Her statements reaffirm her stance on encouraging a clear, rule-based framework over aggressive enforcement actions. Peirce’s emphasis aligns with efforts to remove uncertainty.

Hester Peirce’s remarks emphasize the importance of fostering innovation while ensuring compliance. She argues for practical regulations that differentiate between legitimate and harmful actors, particularly in the context of retail investor protection and market stability.

The immediate effect of Peirce’s comments is seen in discussions among industry leaders. While Bitcoin remains highlighted positively, concerns over memecoins and speculative tokens persist. Peirce’s words may influence future regulatory approaches.

Peirce’s advocacy for clarity impacts financial policies and may alter future escrow and disclosure practices. Her comments urge consideration of innovation-friendly rules, potentially easing the pathway for compliance and market growth in the crypto sector.

While not directly impacting markets, Peirce’s stance contributes to ongoing regulatory dialogue. As discussions continue, the need for balanced regulation becomes more pertinent. Market observers await further SEC actions guided by these principles.

Insights suggest Peirce’s emphasis on transparency and clear rules could foster financial stability.

“One complaint I’ve had is that in an environment of regulatory uncertainty, it’s much harder to identify bad actors—and it gives them more room to operate. Meanwhile, it pushes legitimate actors out of the U.S. or out of the industry entirely. We need to create a good environment for the good actors and a bad one for the bad actors.”

Historical trends show the market tends to react positively to definitive regulatory guidelines, reducing volatility and encouraging sustainable growth in digital assets.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |