- SEC Chair Atkins commends the House’s GENIUS Act passage, aiming for modernization.

- Broad bipartisan support seen for the GENIUS Act’s goals.

- U.S. vision for becoming the crypto capital gains momentum.

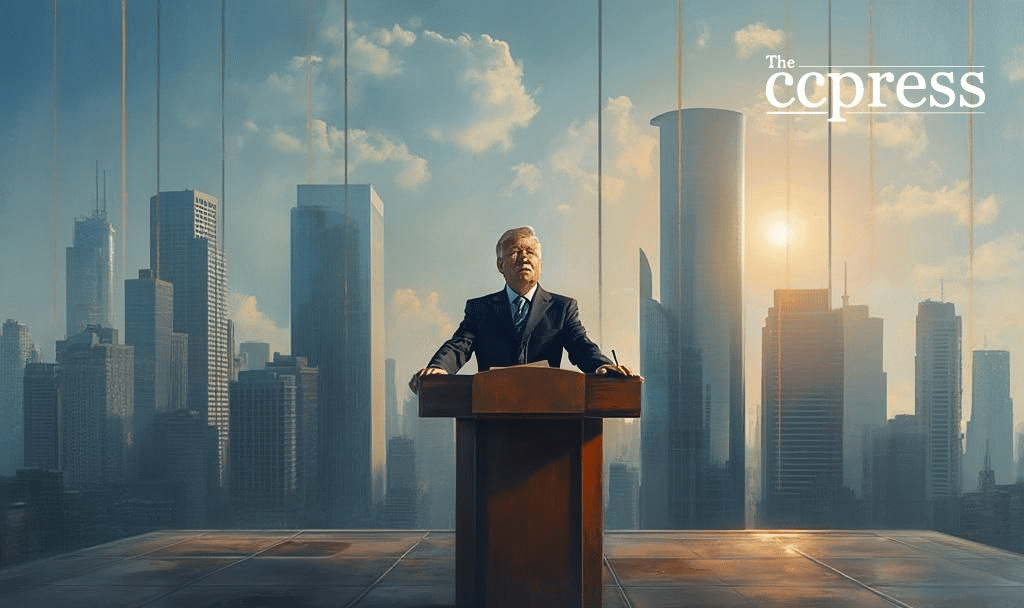

Paul S. Atkins, Chairman of the U.S. SEC, praised the House for passing the GENIUS Act, sending it to President Trump’s desk for approval.

This legislative move represents a significant step toward modernizing U.S. payment systems and could position the country as a leader in crypto innovation.

The GENIUS Act, led by Senator Bill Hagerty, targets a regulatory framework for payment stablecoins, enhancing efficiency and transparency. Atkins applauded Congress’s efforts as the bill reached the presidential phase. Known for his pro-innovation focus, Atkins highlighted potential benefits to America’s financial structure. The GENIUS Act aims to increase transparency and safety by establishing federal rules for payment stablecoins, a significant shift in the regulatory environment.

“I would like to congratulate the House of Representatives on passing the GENIUS Act and commend the work both the House and Senate put into this important legislation. Advancement of this bill to President Trump’s desk marks a historic milestone for crypto entrepreneurs, financial market participants, and everyday Americans…” — Paul S. Atkins, Chairman, U.S. SEC

The passage holds many implications for financial markets. Increased demand for U.S. Treasuries may result due to stablecoin collateralization. Market clarity and risk protections are expected to improve, primarily benefiting U.S. stablecoin issuers. Historical market reactions to regulatory clarity reveal potential volatility, similar to Bitcoin ETF decisions. Market participants anticipate shifts in liquidity preferences and increased TVL (Total Value Locked) in compliant stablecoins. The GENIUS Act could prompt broader adoption of U.S. stablecoins, impacting associated tokens. Increased demand for tokens like USDC and potential shifts in DeFi protocols are likely, contributing to a dynamic market response. As developers adapt to the new framework, broader economic influences could manifest over time.

Overall, the GENIUS Act’s progression illustrates a pivotal moment for the U.S. crypto regulatory landscape, with potential long-term impacts on stablecoin frameworks and financial innovation. Stakeholders eagerly await the presidential signature and subsequent market adaptations.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |