- Kiyosaki hopes for Bitcoin decline to enhance investment.

- Advocates buying during price drops.

- Influences retail sentiment but no drastic market change.

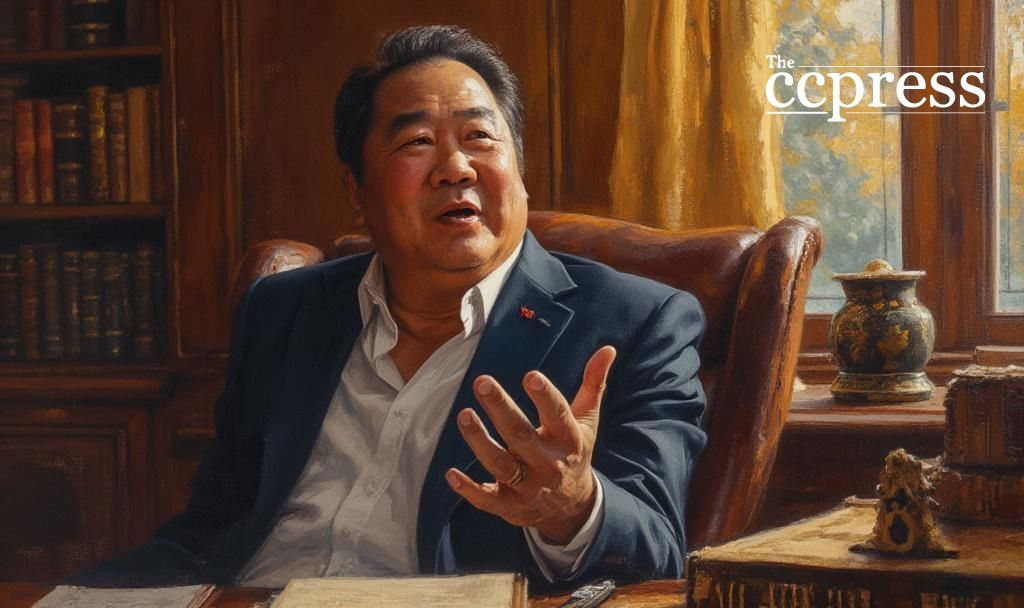

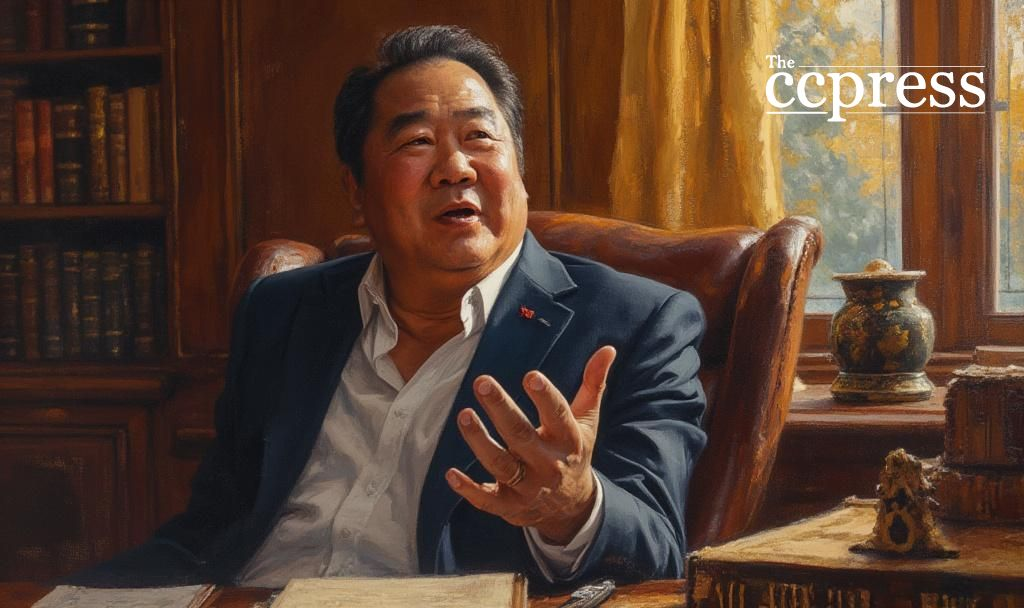

Robert Kiyosaki, renowned for “Rich Dad Poor Dad,” recently shared his wish for a Bitcoin price decline via his official X account, highlighting his intent to purchase more of the cryptocurrency during downturns.

Kiyosaki’s statement underscores beliefs about Bitcoin’s scarcity and fiat currency concerns. Encouraging long-term accumulation, his comments mainly affect retail sentiment, not causing significant market shifts.

Kiyosaki, a known advocate for hard assets like Bitcoin, recently stated his desire for a Bitcoin crash to increase his holdings. He uses X (Twitter) to communicate this investment approach, staying consistent with his long-term strategy.

No institutional response or market shifts link directly to Kiyosaki’s remarks. Bitcoin experienced minor recent slippage, but analysts do not attribute this to his statement. Kiyosaki continues to prioritize Bitcoin over traditional fiat due to concerns regarding inflation.

Robert Kiyosaki, Author, “Rich Dad Poor Dad,” stated, “CLICK BAIT Losers keeps warning of a Bitcoin crash. They want to frighten off the speculators. I hope Bitcoin crashes. I will only buy more. Take care.”

The Bitcoin price decreased about 1.6% recently, though not directly caused by Kiyosaki’s comment. His perspective influences retail investors more than institutions, aligning with his history of promoting accumulation strategies during market corrections.

With no financial institutions reacting directly to Kiyosaki’s call, his impact is mostly on retail sentiment. Kiyosaki’s prediction that Bitcoin could hit $1 million reflects broader macroeconomic trends. Inflation, central bank actions, and Bitcoin’s limited supply underpin his approach.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |