- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Focus on blockchain for capital markets.

- Impact on tokenized securities explored.

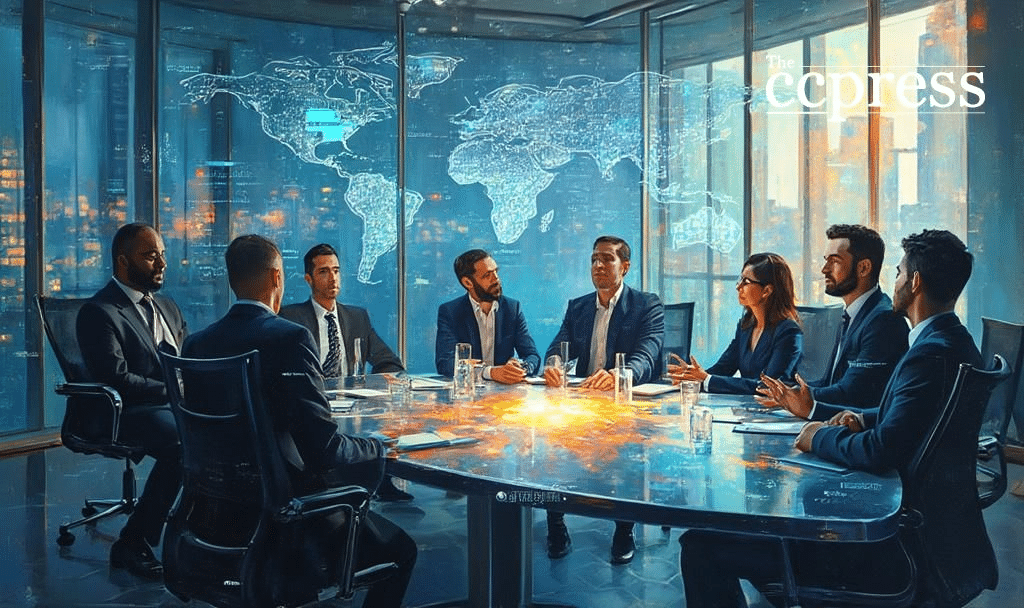

These discussions look to evaluate blockchain’s role in capital markets and assess regulatory strategies. Community reactions remain cautious, with attention on potential operational shifts.

JP Morgan and the SEC Crypto Task Force examined how existing capital markets might integrate with public blockchains. Scott Lucas, Justin Cohen, and Aaron Iovine from JP Morgan led discussions. This engagement reflects an ongoing effort to bring digital financing into traditional finance.

The immediate effects could see tokenized assets such as digital repos gaining traction. Industry players remain attentive to these developments, though no immediate regulatory changes were announced. Broader financial impact may see increased institutional interest in blockchain-based financial instruments.

Potential outcomes include a shift towards digital securities, impacting Ethereum

and DeFi protocols. Historical trends show growing institutional engagement with tokenization, suggesting progressive technological adaptations and regulatory policy evolution.

“Exciting? Yes. Important? Absolutely… Tokenized debt, equity, and investment funds present an opportunity for tailored regulation for securities that are offered and traded via digitally native methods” – Paul Grewal, Chief Legal Officer, Coinbase

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |