- Hacken faces backlash over security oversight.

- HAI token experiences dramatic drop.

- Incident emphasizes need for secure key management.

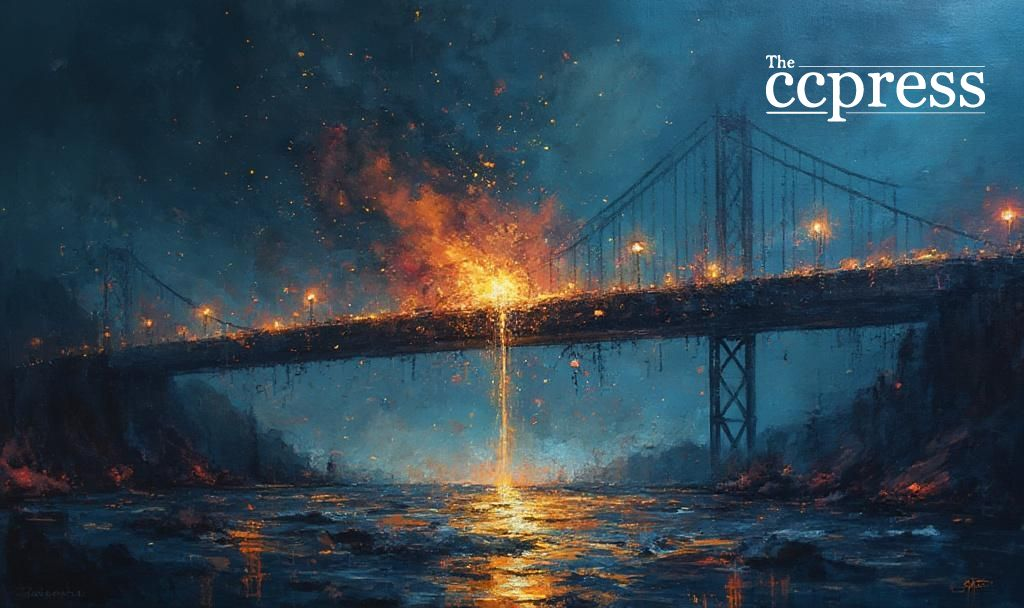

Hacken’s recent incident has highlighted vulnerabilities in Web3 security practices. A compromised private key linked to bridge deployment allowed an exploit leading to the minting of 900 million HAI tokens. Cyvers Alerts describes the situation: “Today, @hackenclub appears to have suffered a security breach across $BNB and $ETH networks. The deployer wallet of the $HAI token seems to be compromised, allowing the attacker to transfer funds.”

Hacken confirmed on social media that the breach involved undermined key security, pointing out the flaw in cross-chain bridge management. Both Ethereum and Binance bridges are affected, causing a significant investor confidence setback. Industry Analyst noted the implications: “The rapid collapse of a major security company’s token underscores the persistent risks of key management in DeFi—even among industry ‘experts’.”

The financial market reacted sharply as 900 million tokens were minted, leading to a 97-98% price crash, reducing the HAI token’s value to near zero. This has echoed past catastrophic token events due to security lapses.

The compromise led to immediate liquidity and price crises, identifying persistent risks in DeFi. Regulatory entities have yet to comment; however, the corrective measures and communication strategies by Hacken are closely watched.

Hacken’s ongoing investigation aims at restoring trust and security in DeFi infrastructures, with a focus on rectifying vulnerabilities. Cryptorobotics highlights the potential technology needed to enhance blockchain security.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |