- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Pulte’s announcement marks a potential industry shift.

- The study could impact mortgage qualification standards.

This initiative suggests potential broader adoption of cryptocurrencies. Immediate market reactivity is speculative, but industry eyes are keenly watching.

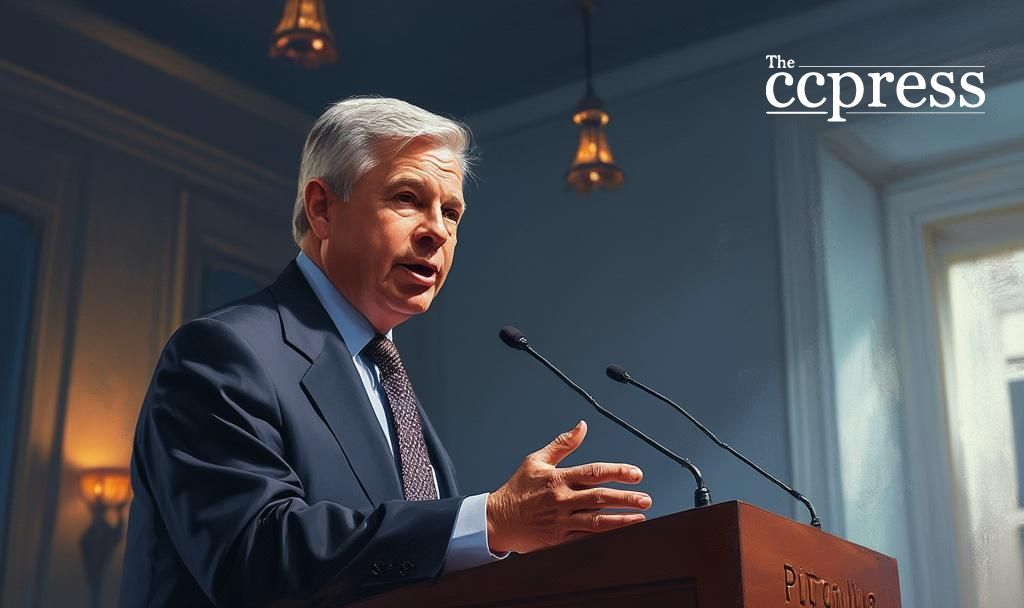

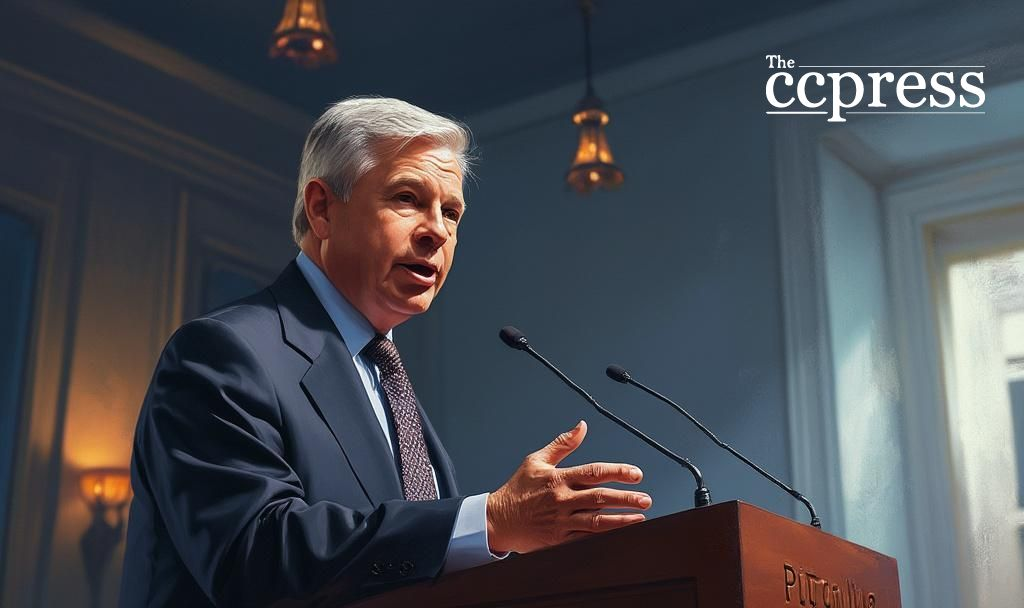

The Federal Housing Finance Agency, led by Bill Pulte, is considering using Bitcoin in mortgage applications. Pulte, a known cryptocurrency advocate, shared plans to study this integration. Bill Pulte, Director, Federal Housing Finance Agency (FHFA), stated,

“We will study the usage of cryptocurrency holdings as it relates to qualifying for mortgages.”

This action represents a step toward incorporating digital assets.

Bill Pulte’s announcement involves Bitcoin and possibly Solana. This move could transform how digital assets are valued in mortgages. The FHFA’s interest reflects a growing trend in mainstream financial sectors evaluating cryptocurrency’s role.

Bitcoin’s inclusion could alter financial markets and housing sectors. The decision may spark changes globally, as other nations observe the U.S. approach. Discussions are underway on major platforms like Twitter, indicating widespread attention.

The FHFA’s stance influences mortgage policy, shaping the future of digital asset use. Crypto markets remained relatively stable post-announcement, yet industry conversations heat up on potential regulatory implications.

If the FHFA endorses Bitcoin, it can lead to significant regulation and technological advancements. This announcement aligns with historical trends of increasing digital asset acceptance, signaling change in traditional finance norms.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |