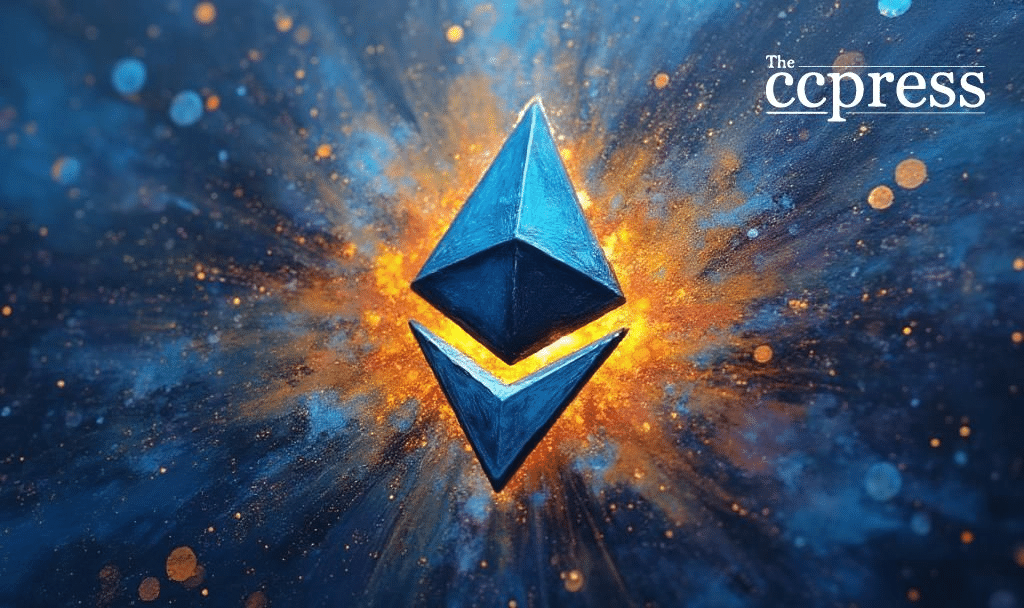

- Ethereum hits $3,600 with significant ETF inflows.

- 7.7% daily and 23% weekly gain observed.

- No current official statements from Ethereum leaders.

Ethereum has surpassed the $3,600 mark on July 18, 2025, following robust institutional interest, as confirmed by Binance Market Data.

ETH’s price surge highlights increasing institutional confidence, drawing historic ETF inflows. Market reaction is notably bullish, with positive impacts on related assets.

“Ethereum has crossed the 3,600 USDT benchmark and is now trading at 3,600.629883 USDT, with a 7.48% increase in 24 hours…” — Binance Market Data, Binance.

Ethereum (ETH) broke above $3,600, significantly influenced by strong ETF inflows. Binance confirmed this milestone, noting a 7.48% increase in 24 hours. The event represents significant investor interest, paralleling previous market momentum.

Co-founders and major entities like the Ethereum Foundation have yet to comment. However, exchanges such as Binance reported the event prominently. Institutional ETF inflows totaled $727 million, marking the largest since January 2025.

The market impact extends beyond ETH. With BTC trailing at a 13% increase, overall sentiment remains positive. Related tokens on Layer 2 and in DeFi space also show increased activity, driven by historical price patterns observed post-upgrades.

Investors might expect sustained momentum, influenced by protocol upgrades and high on-chain activity. Past ETF-induced rallies demonstrate potential for further price increases. The outlook remains positive given stable market indicators.

Ongoing sentiment remains optimistic, despite a lack of immediate regulatory commentary. The notable institutional participation affirms confidence in Ethereum’s long-term prospects. Historical trends further suggest continued market strength.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |