- Analysts expect the crypto rally to resume despite the recent dip.

- Institutional investors play a critical role in asset growth.

- Stablecoins and Bitcoin remain focal points of market interest.

Crypto market analysts expect a rally to resume shortly after an initial dip tied to hawkish Federal Reserve minutes. Institutional investors maintain strong involvement in key digital assets, with expected growth in Bitcoin and Ethereum demand.

Stronger institutional inflows signal increasing confidence in the crypto market recovery, underscoring anticipated long-term growth.

Analysts anticipate the continuation of the crypto market rally despite a minor dip following hawkish Federal Reserve minutes. This optimism stems from strong institutional investments and sustained interest in major cryptocurrencies.

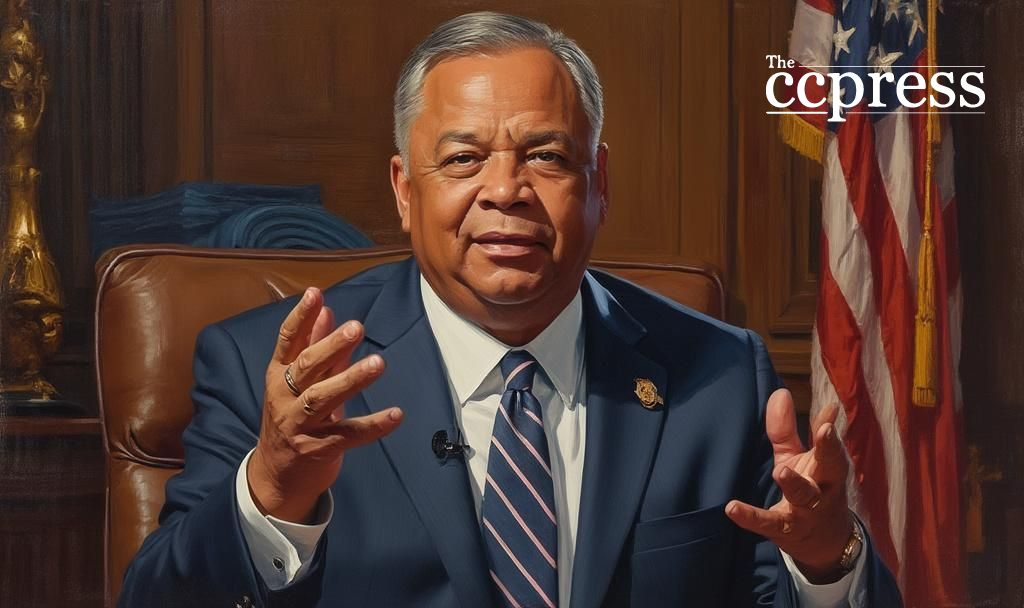

Alex Thorn and Charles Yu, prominent figures at Galaxy, have shared insights indicating potential market expansion. Their analysis highlights evolving stablecoin environments and increasing institutional participation in Bitcoin and Ethereum.

The dip has not deterred institutional investors, who continue robust engagement with Bitcoin and Ethereum. Retail interest also remains high, with many planning to increase their crypto holdings, reflecting broader market optimism.

Financial analysts point to regulatory clarity in the stablecoin sector as a catalyst for growth, promoting a stable market environment conducive to new financial innovations and products.

Predictions indicate growth in staking rates for Ethereum, suggesting potential value appreciation amid tightening supplies. This positions Ethereum for robust performance during anticipated market rallies.

Market dynamics reflect precedent, as similar macroeconomic uncertainties previously led to short dips followed by strong rebounds. The introduction of ETF products supports the expectation of renewed inflows and sustained growth.

“Total stablecoin supply will double to exceed $400bn in 2025. Stablecoins have increasingly found a product-market fit for payments, remittances, and settlement. Increasing regulatory clarity for both existing stablecoin issuers and traditional banks, trusts, and depositories will lead to an explosion of stablecoin supply in 2025.” — Alex Thorn, Head of Firmwide Research, Galaxy

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |