- Coinbase emphasizes blockchain in crime fight, regulatory dialogue rises.

- Grewal criticizes “shoddy” regulatory reports.

- No immediate asset movement linked to statements.

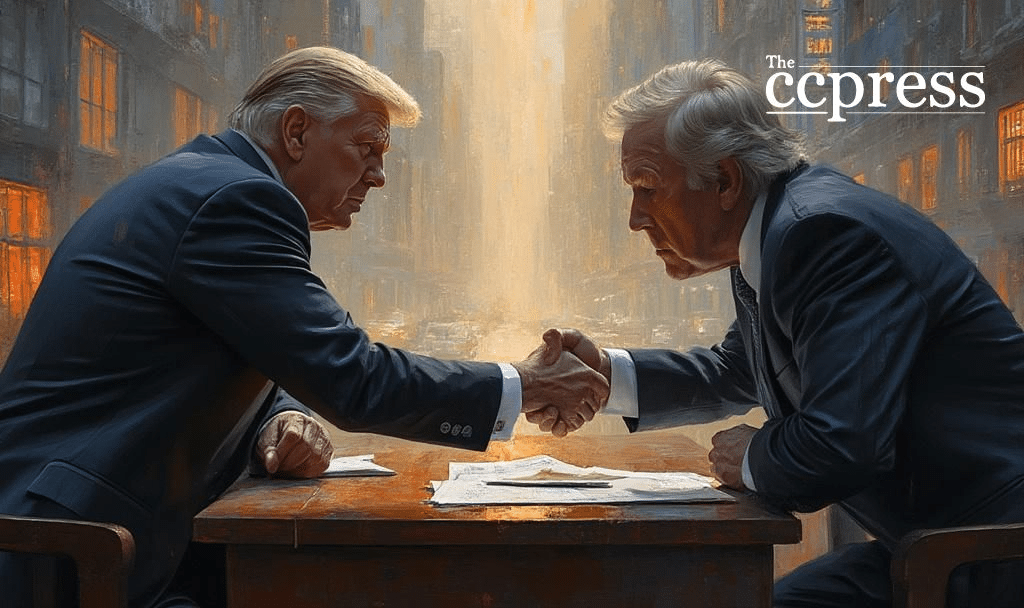

Coinbase’s CLO Paul Grewal spotlights blockchain transparency in combating financial crime, critiquing government reports for overlooking this aspect. Highlighting transparency’s importance, comments were made widely on social media platforms.

Coinbase’s focus on blockchain as a tool against crime calls for regulatory clarity, though no immediate market shifts occurred from these announcements.

Paul Grewal highlighted how blockchain’s traceability enables effective monitoring of cryptocurrency transactions, particularly criticizing a U.S. GAO report as lacking comprehensive analysis on the subject. His statements underscore ongoing efforts in achieving transparent digital financial systems.

Grewal, along with Grant Rabenn, has been vocal about leveraging blockchain forensics to combat illicit activities. They stress the importance of using varied forensic tools to trace transactions, furthering government collaboration.

The advocacy for transparency aligns with Coinbase’s mission for accountable digital transactions. CEO Brian Armstrong’s support for blockchain-based transparency adds to this narrative, although no specific market assets have experienced volatility due to these comments.

Paul Grewal’s remarks aim to reshape regulatory perceptions, arguing that public blockchains provide more visibility than the sector is credited for. The emphasis calls for fair reflection of blockchain’s potential in policy-making.

Coinbase’s strategic perspective on regulatory engagement supports broader trust in cryptocurrency markets. The company continues to assert its importance in compliance, as regulatory clarity becomes pivotal in digital asset discussions.

Regulatory momentum around blockchain transparency may redefine financial crime prevention strategies. As demonstrated by Coinbase’s past collaboration with law enforcement, these discussions potentially shape future regulatory frameworks, bolstering market credibility through verified transactions.

GAO performed ‘zero analysis’ to measure how widely used crypto is for sanctions evasion… the report itself admits crypto transactions are transparent on public blockchains, enabling tracking. – Paul Grewal, Chief Legal Officer, Coinbase

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |