- Bitcoin reaches new heights amid tariff reductions.

- Market shows strong bullish sentiment, exceeding resistance levels.

- U.S.-China agreement enhances global risk appetite.

U.S.-China trade negotiations in Geneva led by Treasury Secretary Scott Bessent and Vice President He Lifeng ease tariff tensions, boosting Bitcoin above $105,000.

The easing of U.S.-China tensions lifts Bitcoin as investors turn risk-on. The resulting rally sees BTC break past $105,000, marking increased market confidence.

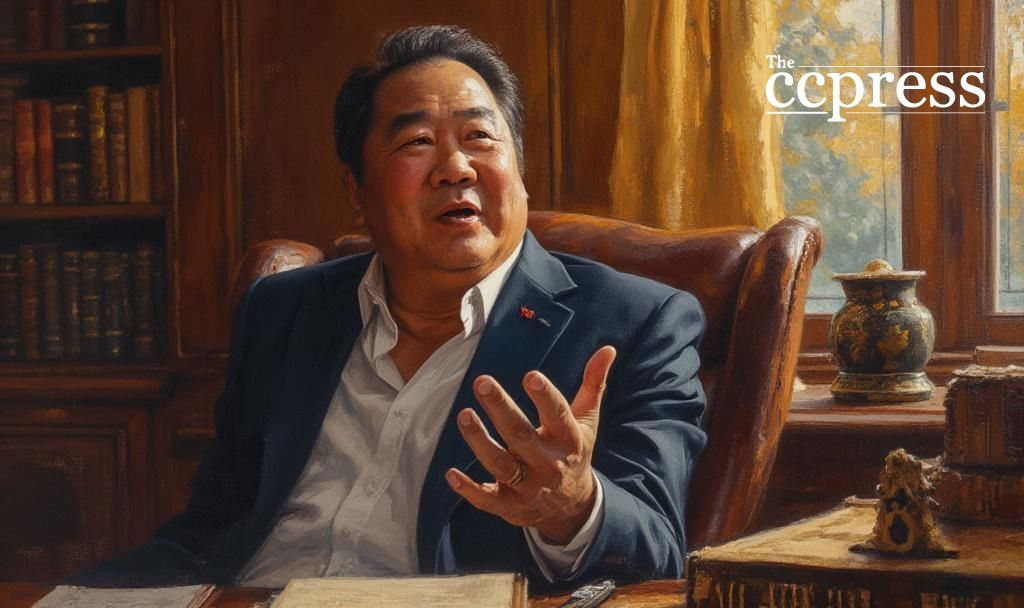

U.S. Treasury Secretary Scott Bessent and Chinese Vice President He Lifeng led recent talks in Geneva. Their negotiations resulted in easing trade tensions, positively affecting global markets. This breakthrough is considered a catalyst for current crypto trends.

Bitcoin surged past $105,000 following the trade announcement, reflecting a bullish shift among investors. Institutional inflows into Bitcoin ETFs exceeded $1 billion, indicating renewed confidence amid the easing of tariffs.

Financial markets reacted positively, with Bitcoin trading volume surging on exchanges like Bitfinex, Binance, and Coinbase. The geopolitical climate has driven increased demand for crypto investments, suggest analysts. David Ingles reports on key trade meeting updates.

The settlement of trade disputes often aligns with risk-on sentiments, potentially leading to greater engagement in crypto assets. Historically, Bitcoin reacts to such macroeconomic changes with increased volatility. Market analysts predict further inflows into cryptocurrency markets as conditions evolve.

On-Chain data shows significant BTC spot and futures trading growth. Historical precedent suggests that Bitcoin and other cryptocurrencies may benefit from expanding global liquidity and reduced economic barriers. Investor sentiment remains strongly bullish, fueling further momentum in Bitcoin markets.

The U.S.-China tariff deal is a clear signal to risk-on investors. The reduction in protectionist barriers should unlock global liquidity, historically a tailwind for Bitcoin and other high-beta cryptoassets.

Andre Dragosch discusses implications of trade negotiations, highlighting the potential for future market developments.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |