- Bitcoin ATM installations in Europe hit a record in May 2025.

- Markedly increased retail crypto access.

- Operators face regulatory challenges amid EU AML policies.

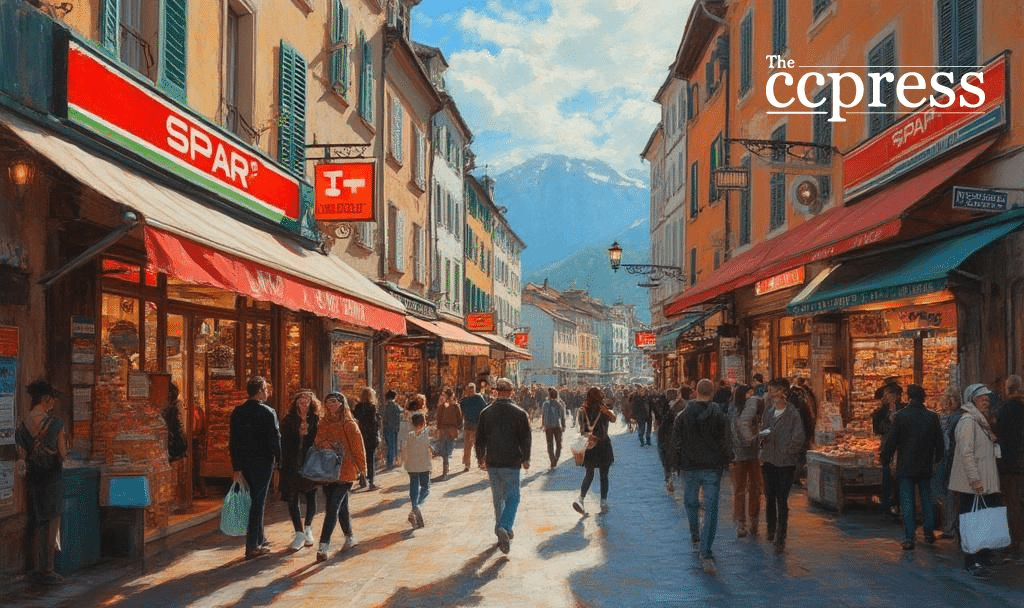

In May 2025, Europe’s Bitcoin ATM installations achieved a historic high of 1,767 units, marking a significant expansion across the continent driven by numerous operators in a competitive market.

Growing interest in cryptocurrencies and the establishment of 1,767 ATMs across Europe underscore increased demand for retail accessibility and potential impact on trading volumes. The expansion reflects the proactive initiatives of over 350 operators, with Localcoin and Bitcoin Depot being notably active. Europe’s record installation of Bitcoin ATMs in May 2025 involved many operators, some of which are already established in other regions, including Spain. No executive statements have directly addressed this installation milestone.

The industry’s growth coincides with potential regulatory challenges as the European Union tightens anti-money laundering rules. This situation presents increasing compliance concerns for Bitcoin ATM operators, impacting their strategies going forward. Although Bitcoin’s primary impact from increased installations is evident, Ethereum and select altcoins may also experience indirect effects where machines support additional tokens.

“Bitcoin ATM operators in Europe, among other providers of services offering anonymous exchange between crypto and cash, may be affected by upcoming stricter anti-money laundering rules in the European Union.” — European regulatory source, Anonymous, Regulatory Expert, European Union.

The heightened retail accessibility of Bitcoin and other cryptocurrencies, influenced by Europe’s ATM spikes, may stimulate trading activities. As operators increase installations, they face heightened compliance hurdles due to evolving regulations. Bitcoin’s retail adoption faces potential regulatory obstacles, as heightened oversight poses challenges to anonymous transactions, potentially modifying ATM operational protocols. While near-term trading impacts are uncertain, historical trends suggest eventual increases in localized trading volumes following ATM expansions. The introduction of stringent AML guidelines could reshape the landscape for crypto services, impacting investor confidence in the region.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |