- Main event: Bipartisan legislation passed, impacting crypto markets.

- CLARITY Act aims at consumer protection, developer support.

- Transforms regulatory landscape and increases U.S. market transparency.

The passage of the CLARITY Act is an important step for the U.S. digital asset market, with potential to simplify and solidify its regulatory framework.

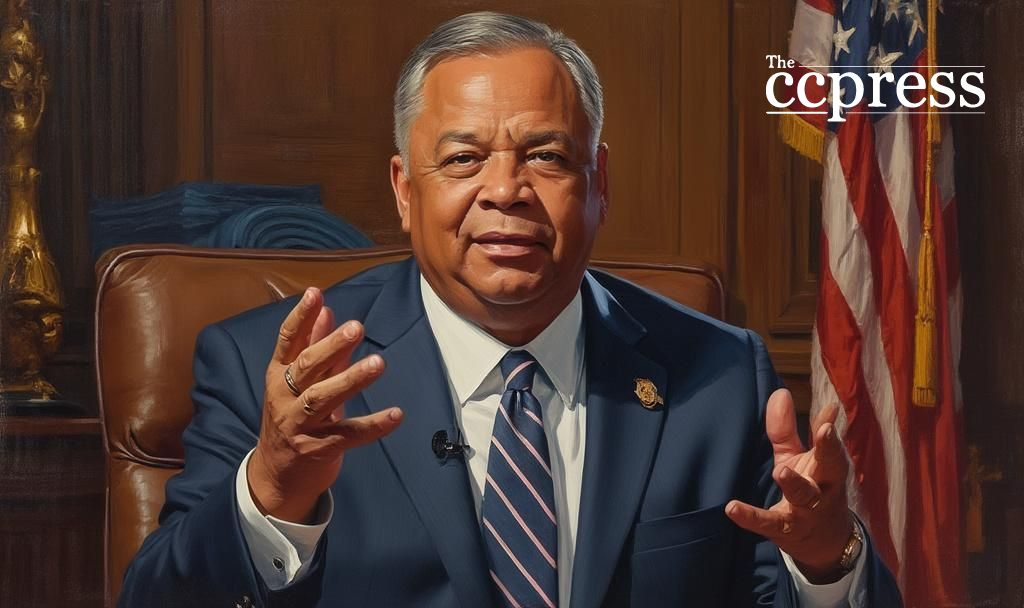

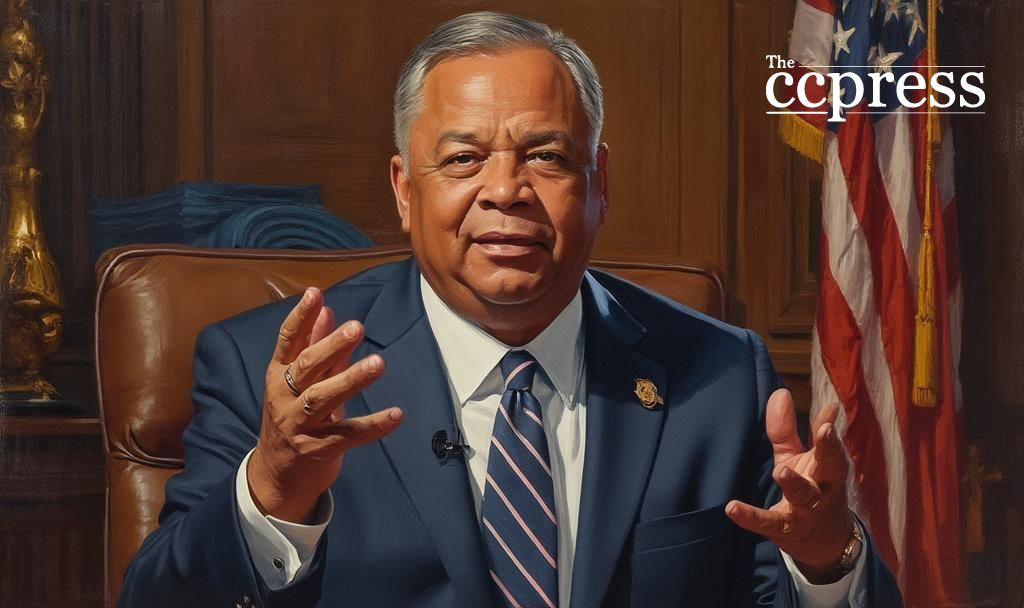

Rep. Dusty Johnson, a key architect of the CLARITY Act, led the effort for regulatory clarity, aiming to bolster the U.S. as a leader in digital assets. The Act provides specific jurisdictional boundaries between the SEC and the CFTC for major cryptocurrencies. Co-sponsors include leaders from both parties, underscoring the broad political support for the Act. It also impacts stablecoins with national reserve requirements, supporting the U.S. dollar’s dominance.

“The regulatory certainty provided by CLARITY will launch a golden age of digital assets, transforming every industry like the internet did. Today is a watershed victory for America.” — Dusty Johnson, Representative, United States House of Representatives

The immediate effects of the Act include increased confidence among institutional investors and developers, as regulatory risks are mitigated. It is expected to encourage new investments in U.S. crypto markets as jurisdictions become clearly defined. Regulatory implications affect consumer protection and market structures, aiming to strengthen the industry and promote innovation within the United States. Key cryptocurrencies such as BTC, ETH, and stablecoins will see clear regulatory paths, influencing compliance interest among blockchain projects.

The House Financial Services Committee document on digital assets highlights insights suggesting potential outcomes from clarified regulations include enhanced market growth and cross-border collaboration due to lowered compliance barriers. Historical trends in crypto regulation highlight the challenge of aligning legal frameworks with market dynamics, a balance this Act strives to achieve by accommodating both traditional and digital financial markets.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |