- Binance settles DOJ charges, CEO resigns.

- Regulatory compliance changes enforced.

- Market reactions muted, regulatory impacts assessed.

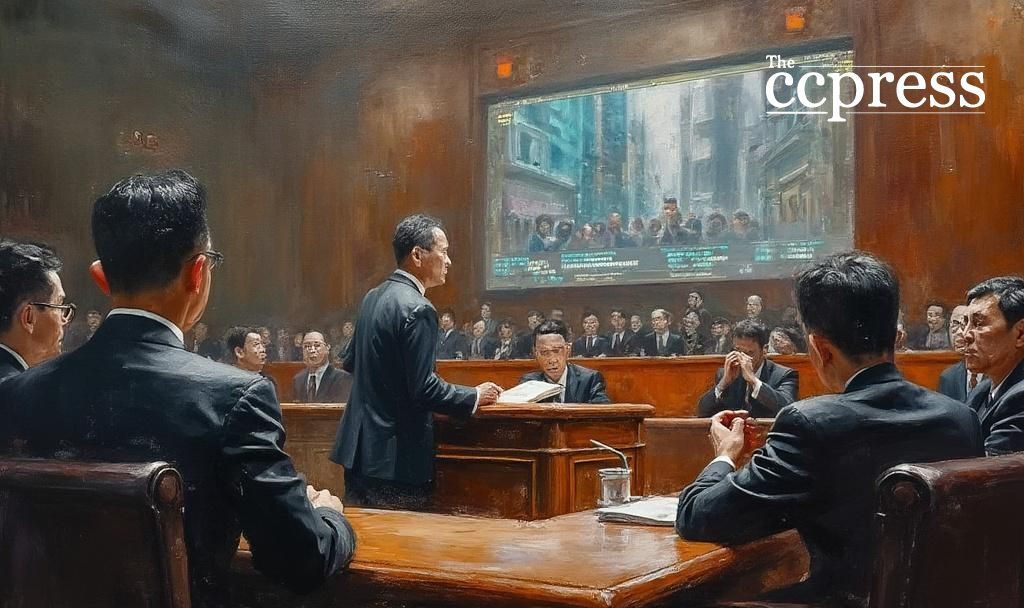

Binance, the global cryptocurrency exchange, agreed to pay $4.3 billion in a settlement with U.S. authorities on November 21, 2023, leading to CEO Changpeng Zhao resigning. The settlement addressed anti-money laundering compliance failures.

The settlement reflects authorities’ efforts to enforce stringent compliance in the crypto sector, impacting Binance’s operations and its credibility. Market reactions remained subdued, potentially suggesting regulatory effects were anticipated.

In a significant settlement, Binance agreed to pay $4.3 billion to the U.S. Department of Justice for failing to maintain effective anti-money laundering protocols. Changpeng Zhao’s resignation was part of the agreement, shifting leadership at the cryptocurrency giant. “From the very beginning, Zhao and other Binance executives engaged in a deliberate and calculated effort to profit from the U.S. market without implementing the controls required by U.S. law,” noted Attorney General Merrick Garland.

As part of the settlement, Binance admitted to anti-money laundering violations, marking a significant compliance overhaul for the exchange. The decision follows increased scrutiny from regulatory bodies globally. The firm must now navigate a comprehensive exit from the U.S. market.

The settlement has put regulatory compliance at the forefront of Binance’s recent operational changes. Analysts noted market responses were mild, suggesting investors anticipated the resolution. The settlement might influence future regulatory approaches in cryptocurrency exchanges.

Financial implications of the settlement have focused attention on existing regulatory frameworks. While Binance must revamp its compliance efforts, the broader industry could face strict scrutiny. Historical trends show regulatory actions might drive changes across the crypto landscape.

Potential outcomes could involve stricter regulatory alignment as Binance implements mandated compliance measures. Analysts believe this event signals an increasing focus on regulatory oversight, impacting the sector’s technological and financial evolution, necessitating strategic reforms.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |