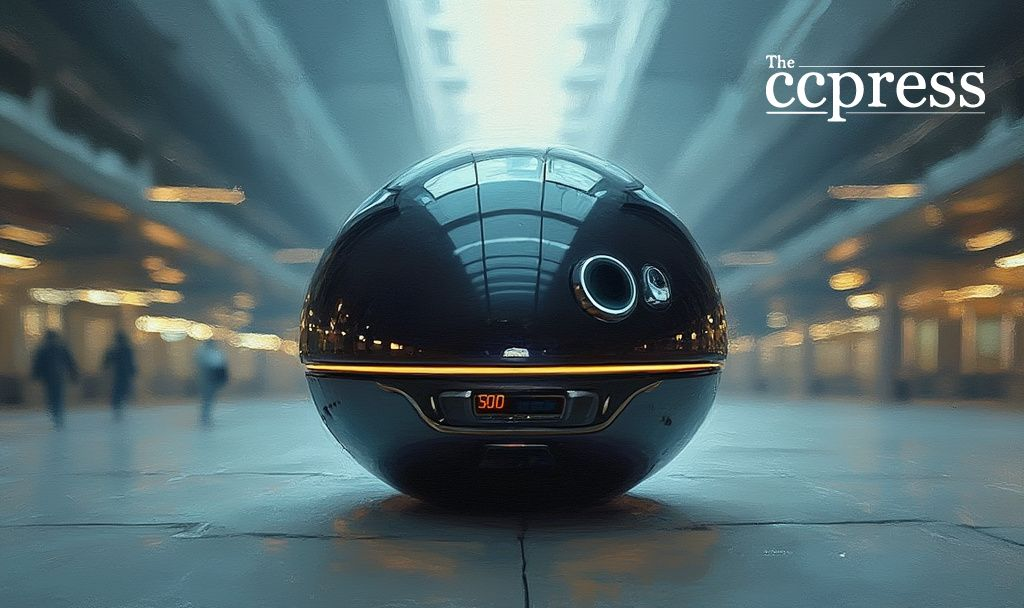

- Worldcoin launches new portable biometric device in the US.

- Orb Mini allows more accessible identity verification.

- Device could become a point-of-sale terminal.

Worldcoin’s launch of the Orb Mini signifies potential shifts in digital identity verification and commercial transactions, while promising a more accessible technology for U.S. users.

Tools for Humanity, which supports the World Network, has unveiled its latest device, the Orb Mini, in the United States. The device aims to simplify identity verification through portable iris scanning technology and offers further expansion into biometric solutions.

The Orb Mini’s development is spearheaded by industry figures like Sam Altman and Alex Blania. It represents Tools for Humanity’s stride to broaden identity technology reach, especially in the U.S. market, building on prior advances with their larger Orb devices.

“The Orb Mini represents a significant step forward in making identity verification accessible through iris scanning technology.” – Sam Altman, CEO, Worldcoin TechCrunch

The introduction of the Orb Mini could have immediate implications for the retail sector as the device evolves into a mobile point-of-sale terminal. Such advancements highlight a shift towards integrating identity verification in commercial transactions.

Worldcoin’s expansion demonstrates its focus on digital verification growth, with significant investments aiding its mission. Tools for Humanity is expanding its physical U.S. presence, suggesting broader adoption of biometric strategies.

Analysis suggests the Orb Mini’s introduction will likely encourage wider adoption of human verification solutions across markets. This is supported by Tools for Humanity’s strong funding base, hinting at potential market shifts towards biometrically secured operations.

Tools for Humanity’s strategy involves potentially licensing its sensor technology, enabling greater sector integration. As biometric authentication gains ground, this may catalyze regulatory and technological advancements, parallel to trends observed with digital payment solutions.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |